The FASB introduced a more transparent and inclusive standard-setting process, involving extensive public consultation and rigorous due process. This approach not only enhanced the credibility of the standards but also ensured that they were more attuned to the needs of a diverse range of stakeholders. The FASB’s conceptual framework, introduced in the late 1970s, provided a theoretical underpinning for the development of accounting standards, emphasizing the importance of relevance, reliability, and comparability.

American Institute of Accountants

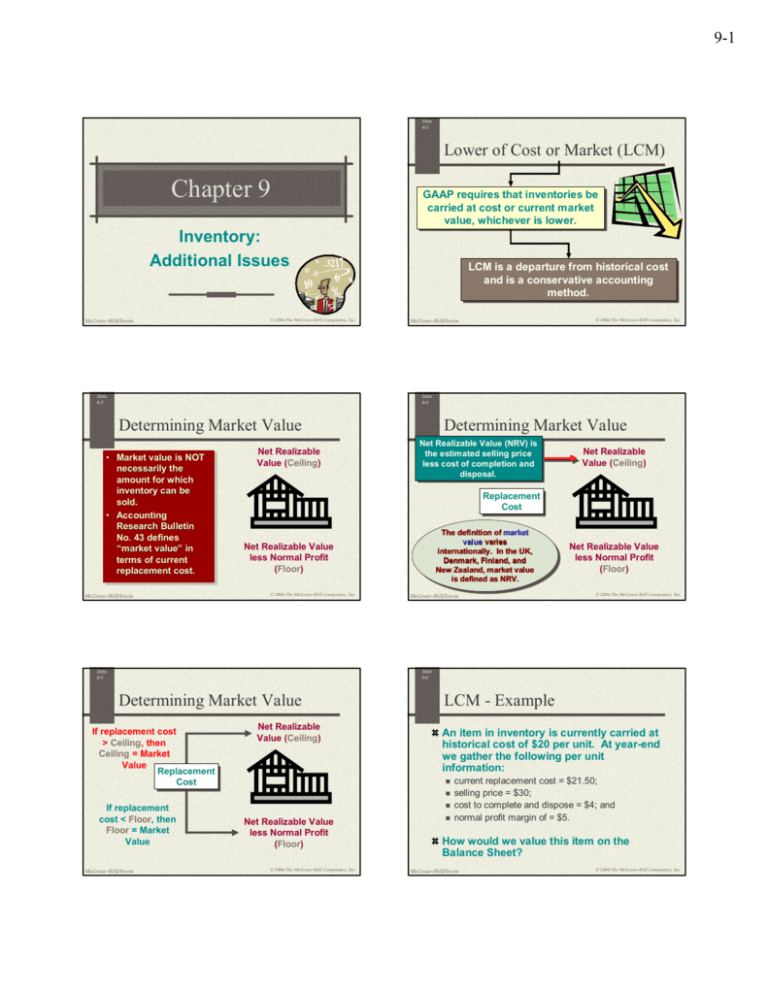

These technologies offer the potential for greater accuracy, efficiency, and transparency, but they also present new challenges that must be addressed through rigorous research and standard-setting. Future accounting research will need to explore how these technologies can be integrated into existing frameworks and what new standards may be required to govern their use. Accounting Research Bulletin no. 43, Restatement and Revision of Accounting Research Bulletins , was the last such compilation, and it was issued nearly half a century ago.

Publication Date

ARBs were not merely technical documents; they represented a concerted effort to bring order and uniformity to a fragmented field. Each bulletin tackled specific accounting issues, ranging from revenue recognition to inventory valuation, providing practitioners with a framework to ensure consistency and comparability in financial statements. This was particularly important in an era when the lack of standardized practices often led to significant discrepancies in financial reporting, making it difficult for stakeholders to make informed decisions. Accounting Research Bulletins (ARBs) have played a pivotal role in shaping the landscape of financial reporting and accounting standards.

Comparative Analysis with Modern Standards

This bulletin recognized that estimates are an inherent part of financial reporting and provided guidance on how to account for changes in these estimates. By clarifying that changes in estimates should be accounted for prospectively, ARB No. 45 helped prevent the manipulation of financial results and ensured that financial statements remained reliable and transparent. This focus on ethical practices and professional judgment is a recurring theme in ARBs, underscoring their broader objective of enhancing the credibility of the accounting profession. The APB sought to build on the foundation laid by ARBs, but with a more rigorous and systematic methodology. Unlike the Committee on Accounting Procedure, which issued bulletins on an ad-hoc basis, the APB aimed to develop a cohesive set of principles that could be universally applied.

- All of this is designed to help accountants apply the fairly basic concept in Statement no. 125 that assets are considered effectively sold when they are no longer controlled.

- Emerging technologies such as blockchain, artificial intelligence, and machine learning are poised to revolutionize financial reporting and auditing.

- While most business people and senior partners of audit firms support general principles in theory, they often ask for much more detailed standards in practice.

- However, one drawback is that the statement runs 245 pages long, much of it among the most complex text of any accounting standard to date.

Sustainability and environmental, social, and governance (ESG) reporting are also gaining prominence in the accounting field. Investors and stakeholders are increasingly demanding more comprehensive disclosures on a company’s ESG performance. This shift towards sustainability reporting requires the development of new metrics and standards to ensure that ESG information is reliable, comparable, and relevant. Accounting research will play a crucial role in shaping these standards, drawing on the lessons learned from the evolution of financial reporting standards to create a robust framework for ESG reporting.

The influence of Accounting Research Bulletins extends beyond the borders of the United States, impacting international financial reporting practices. The principles and guidelines established by ARBs laid the groundwork for the development of more sophisticated accounting standards globally. As countries sought to improve their financial reporting frameworks, many looked to the ARBs as a model for creating their own standards. This cross-pollination of ideas contributed to a more harmonized approach to accounting, facilitating better comparability and transparency in financial statements across different jurisdictions.

Thus, interested parties must search the above sources—and perhaps others, too—to see whether there is accounting literature on point and then decide how it applies to the issue under consideration. While computers help greatly in the identification accounting research bulletin no 43 of applicable literature, humans still must read the material and decide how it should be interpreted. Gains and losses on those instruments are reflected in income in the same periods as offsetting losses and gains on qualifying hedged positions.

This global adoption has not only enhanced the quality of financial reporting but also fostered greater investor confidence and cross-border investment. The best known of the accounting research bulletins was ARB No. 43, which aggregated the information found in the earlier bulletins. Accounting Research Bulletins (ARBs) were a series of publications issued by the Committee on Accounting Procedure (CAP) of the American Institute of Certified Public Accountants (AICPA) between 1939 and 1959. The purpose of these bulletins was to provide guidance, interpretations, and recommendations on various accounting principles and practices. Emerging technologies such as blockchain, artificial intelligence, and machine learning are poised to revolutionize financial reporting and auditing.

Among the numerous Accounting Research Bulletins issued, several stand out for their profound influence on the accounting profession. Issued in 1953, it consolidated and revised previous bulletins, providing a comprehensive framework that addressed a wide array of accounting issues. This bulletin was instrumental in standardizing practices related to inventory valuation, depreciation, and the classification of current and non-current assets. By offering detailed guidance on these topics, ARB No. 43 helped reduce inconsistencies and improved the comparability of financial statements across different entities.