Will you be an adult homeowner located in Arizona, or probably retire on Huge Canyon Condition, and seeking an approach to enhance retirement earnings?

With increasing living expenses and you can inadequate alterations in order to Social Cover masters, you are more than likely effect frustrated. Luckily for us, really senior Us americans is actually residents, causing them to uniquely qualified to access dollars making use of the very put in which they place their lead every night – their property.

It Arizona opposite mortgage publication brings an extensive report about this novel financial tool so that you can create the best choice about whether or not an other financial ‘s the correct choice for you.

Wisdom Opposite Mortgages

Household Collateral Transformation Mortgages (HECMs), often called reverse mortgage loans, try financial products created specifically to have property owners who will be 62 many years old otherwise older.

Rather than antique household security fund otherwise personal lines of credit (HELOCs) that want monthly obligations will eventually, opposite mortgages jobs in different ways.

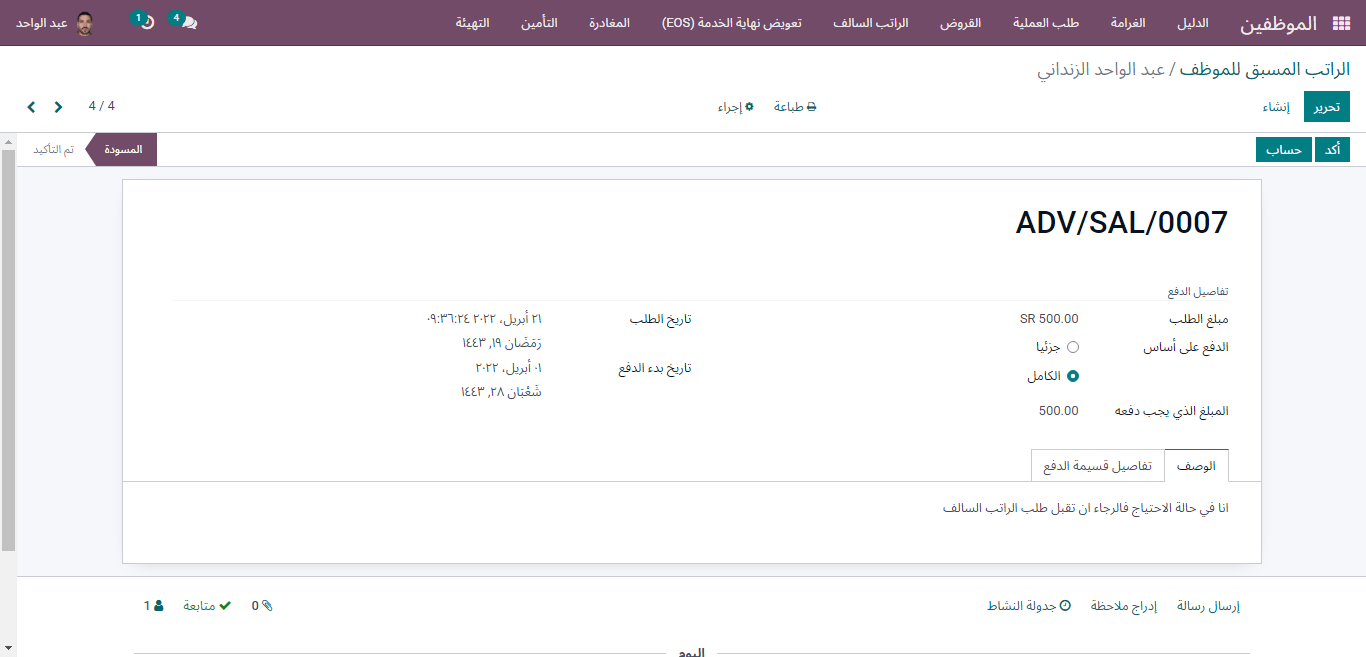

For many who continue to have a traditional home loan on your own home, first thing a face-to-face home loan will do is accept one to mortgage. The remainder reverse home mortgage continues is disbursed centered on the brand new homeowner’s liking: lump-share, typical monthly premiums, line of credit, otherwise a combination of these types of.

No monthly obligations have to pay off a reverse financial. Yet not, residents owe assets fees, homeowners’ insurance policies, and keep maintaining the house.

Cost of an opposite mortgage is brought about if the home owners want to permanently move in, promote the house, or on the new passage of the last enduring resident.

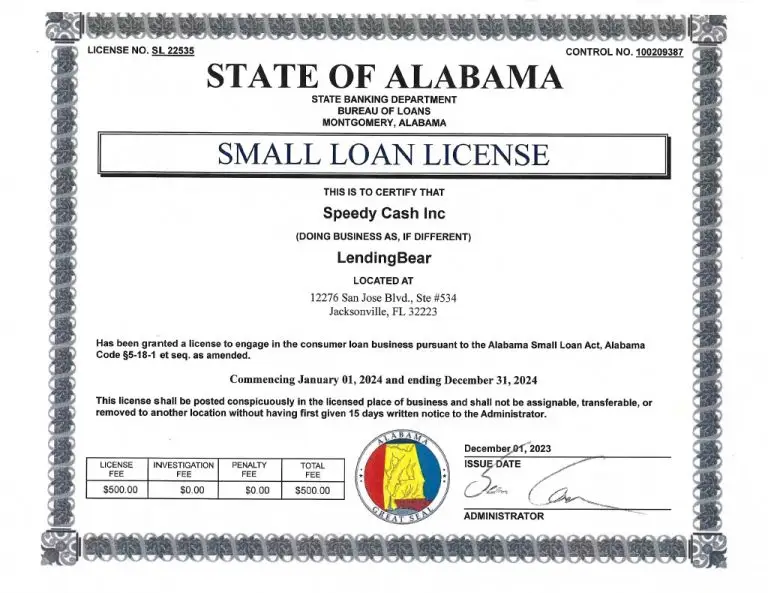

Contrary mortgage loans is actually money that are controlled of the You.S. Department off Construction and you can Urban Innovation (HUD), into backing of the Federal Housing Management (FHA).

Washington Opposite Financial Qualifications Conditions

To be eligible for a reverse home loan inside the Arizona, people need to see particular particular criteria, including the following the:

- Years. One resident have to be at the very least 62 yrs old.

- Residence. The property ought to be the homeowner’s number 1 house.

- Guarantee. We recommend that residents has actually a lot of guarantee in their property.

- Reputation of the house. The house are going to be better-maintained.

- Bills. People must have the latest ways to shelter the fresh constant assets taxes, homeowners’ insurance coverage, HOA fees (when the applicable), plus the best restoration of their domestic.

- Eligible possessions. The house or property are going to be eligible for an opposite financial. Eligible qualities include unmarried-nearest and dearest house, 2-4 equipment features to the resident consuming you to device, FHA-approved condos, otherwise acknowledged are produced house.

- Counseling. Before applying to have a contrary home loan, individuals must match the needs regarding in the process of a comprehensive counseling concept having a 3rd-cluster counseling service passed by HUD.

How an other Financial Will help

Enhance Old age Earnings. A contrary financial also provide a reputable and you may consistent supply of earnings. It monetary alternative support in the layer individuals expenses, along with date-to-big date lifestyle will cost you http://www.paydayloansconnecticut.com/milford-city/, unexpected scientific debts, or any other unanticipated bills.

No Monthly Mortgage payments. Having an opposite home loan, home owners commonly forced to generate month-to-month mortgage repayments. However, they are guilty of possessions taxation, insurance policies, and you may household repairs can cost you.

Ages set up. An other financial allows seniors in which to stay their houses since the they age, which is beneficial for those who have been a lot of time-name citizens and would like to remain near to household members.

Versatile Percentage Options. There are numerous disbursement possibilities that have opposite mortgage loans, taking flexibility to have borrowers to get money. You will find several available options to have acquiring the money. You have the variety of receiving they in one single swelling contribution, since a credit line, inside monthly premiums, or a combination of these methods.