Unsecured loans in Singapore

Money diminished is a very common refrain many of us pay attention to, a whole lot more so right now when rising cost of living are biting more challenging than a beneficial rottweiler.

As you get a hold of a method to mat your finances, maybe you have discover personal loans and you will wondered when they exactly like borrowing from the bank from your own best pal.

Which is merely half right instance financing really are for personal play with, but there’s much more on it than simply being a straightforward avenue for money. Keep reading to determine just what personal loans is actually, and you may if they might be the closest friend as much as people adorable dogs are.

Exactly what are signature loans?

Personal loans are just what you borrow from banking companies and you may financial institutions for your own fool around with. Should it be splurging thereon sinful fulfillment, donating to have a end up in, otherwise stuffing they around a pillow, you will be basically liberated to would any sort of your own heart desires to your money even in the event in terms of financial discipline, it may not become a smart idea to overindulge for the lent currency.

Name financing

Whenever you are good stickler to own balances and you may certainty, next a term mortgage can be for you. That’s where a lender gives you a single-out-of contribution with all of conditions consented upfront in the course of the mortgage:

- Rate of interest: Generally 6%-8%

- Installment period otherwise tenure: Constantly step 1-5 years

- Monthly instalments.

Suggestion #1: Of several financial institutions bring a lower life expectancy interest rate for a longer mortgage cycle. However, it often means a more impressive overall payment. Including, following the over analogy, an annual interest rate of 5% more 4 age means an overall total higher notice regarding $dos,100000 rather.

Suggestion #2: You could request early full cost. However the bank may charge an earlier financing termination commission so you’re able to make up for the death of appeal income.

Rotating financing

Think a beneficial rotating loan if you want a very liquid and versatile answer to control your credit. Referred to as a personal credit line, this type of mortgage acts such as for example a charge card.

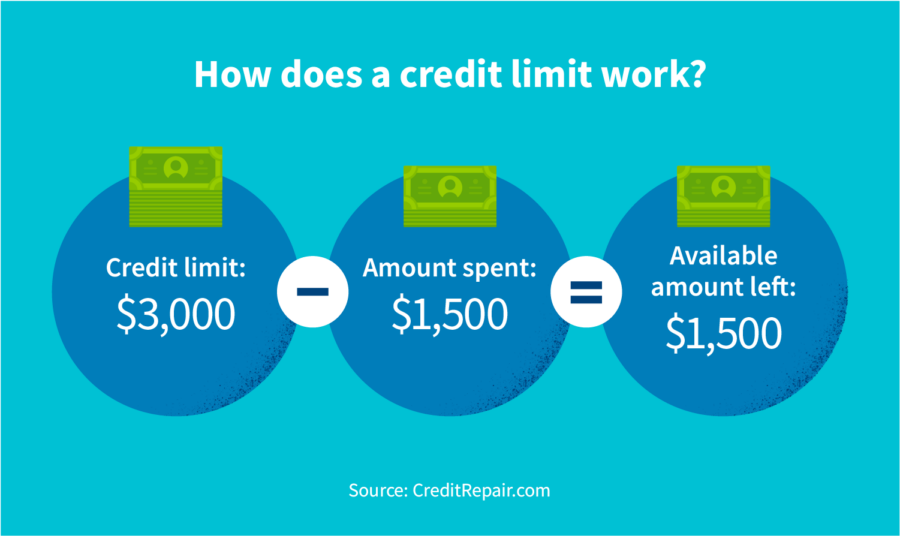

You can withdraw partly or totally off good pre-approved borrowing limit, and you may desire just applies to the sum of lent. Just how much to repay monthly is up to you, and you will all you go back tend to replace the borrowed funds number to you personally to save borrowing and no stop time. Even when financial institutions usually impose at least monthly payment.

The latest catch to for example independency is the fact these types of loans hold a beneficial large interest compared to the a term financing, typically off 18%-20%.

Idea #3: They ount monthly. However, including credit card bills, this can snowball fast from the higher interest rate. A rule of thumb is always to pay off as often so when early that one can, as as opposed to name fund, there’re zero early fees charge.

What the results are after you never pay back an unsecured loan

Section of exactly why are personal loans attractive is that it is an effective kind of unsecured credit; there is no need to hold guarantee otherwise has an effective guarantor to truly get your practical the money. If you cannot pay off that loan, the financial institution never seize your personal property, in the place of a house otherwise car loan.

Nonetheless it doesn’t mean it’s your get-out-of-jail-totally free credit. Defaulting in your mortgage is defectively apply to your credit rating , which procedures just how most likely you are to settle the debt and you can derives off facts offered to the credit Bureau Singapore (CBS) by your borrowing business such as banking institutions and you can finance companies. A woeful credit get can damage your upcoming credit and also employment opportunities.

In more significant instances when the lending company feels you happen to be purposefully withholding payment, they might together with take lawsuit up against your.

The reason why you might require an unsecured loan

Loans to own bad credit unsecured personal loans guaranteed approval 10000 things such as homes, repair, and you can cars could only be taken to your given objective. Have a tendency to, the financial institution disburses the bucks straight to the specialist otherwise specialist, bypassing the debtor completely.

In addition, a personal loan happens directly to your own wallet and you may affords far deeper 100 % free play in the way you may spend the bucks. You can decide on it in a single sitting otherwise divvy upwards for various expenditures for example:

- Medical or any other issues

- Goals otherwise lives options, elizabeth.g., wedding receptions, vacations, big-ticket things such as electronics

- Training

- Small company or front hustle

- Debt consolidation reduction having fun with an unsecured loan to pay off some other outstanding debt which have a greater interest, elizabeth.g., credit cards

- Versatile explore

Exactly how much do you really use?

So you’re able to a loan provider, very little else things except that what you can do so you’re able to coughing back the newest cash on date. Your revenue together with credit rating goes a considerable ways in order to determine how much you can obtain.

Having banking companies, that it means 2-6 times of the monthly salary, capped during the $2 hundred,100000. Alone, licensed moneylenders need follow the following lending caps lay of the Ministry out-of Laws :

Tip #4: In addition to a much bigger mortgage, a good credit score may enables you to enjoy a good much more beneficial interest.

In which & tips pertain

All of our bodies has a virtually eyes towards private credit in Singapore, and never anybody can dish out such financing. Banking institutions and you may subscribed moneylenders try courtroom and by much one particular well-known choice.

Some need during the-people programs, some banks allows you to incorporate on line while an existing consumer. Generally, they will request proof of your own title, address, and you may earnings. Lenders could also look-up your credit score to the CBS.

Your age, nationality, and you will income will be step 3 primary requirements with regards to in order to assessing your loan eligibility. Here’re all round assistance:

What is lesser known is that finance companies tend to choose the very least credit rating of 1,825 too. And this before you apply, you may want to check on your credit rating to the CBS. You can get your credit score from their store getting an affordable percentage regarding $6.42 which have GST.

Aside from the amount borrowed, interest, and you can tenure, it also helps to explain initial on the lender into people hidden charge such as for example:

Approval and disbursement may take as fast as 24 hours when the all the docs come into buy and you are clearly deemed creditworthy.

Bringing a personal bank loan when you look at the Singapore

As with all things money, it pays become wise whenever choosing whether you prefer a beneficial personal loan and you will hence bank to go for.

Usually, such as finance serve as brief-title financing. Acquire inside your means and you may discover these can indeed feel a handy mate in the event the assuming in need.