So if you post a new asset account with a balance, you’d need to offset it by the same amount on the other side of the equation when you first bring balances into accounting software. Using accounting software can help you figure out what is missing, or you can fill out an accounting https://www.bookstime.com/ template and see the numbers in front of you. Not closing out this account makes your balance sheet look unprofessional and can also indicate an incorrect journal entry in your books. The opening balance is the balance that is brought forward at the beginning of an accounting period from the end of a previous accounting period or when starting out. This initial balance sets the stage for the company’s financial management and helps track its progress from the very beginning.

Online accountancy services

Once the business is up and running, unforeseen events may also lead to bad debts having to be estimated and written off. Two of the most common abbreviations that crop up when tackling the accounting process are “b/d” and “c/d. A very simple example can illustrate how the opening balance of a company is calculated. When a company first begins operations, its very first opening balance will be zero, what is opening balance unless funds have been spent before the company was established. To get the opening balance of an organisation, you will need to run the trial balance report.

Calculating the opening balance

It’s brought forward from the closing balance of the previous accounting period. You may choose to have shorter financial periods in order to keep an even closer eye on your business. For this reason, you may want to introduce opening and closing balances on a monthly basis, quarterly or six-monthly basis. Sign up for accounting software to easily create and manage your opening balance equity account here. The opening balance is the amount of funds in a company’s account at the beginning of a new financial period.

We charge a monthly fee based on your business type

- Two of the most common abbreviations that crop up when tackling the accounting process are “b/d” and “c/d.

- At Sleek, we provide accounting services to aid you with an efficient and seamless tax process.

- Your opening balance is how much money your business has at the start of a specified accounting period.

- These may also be coupled with “liabilities”, or debts, if equipment has been purchased through bank loans or investments from other parties.

- Ensuring all finances are accounted for will make filing your income taxes much easier.

- Click here for a free trial of the FreshBooks bookkeeping and accounting services now.

If you’re unsure about any aspect of your taxes or need assistance with financial tax planning, consulting tax advisors at Sleek will save you time, money, and potential headaches. Online Accounting At Sleek, we provide accounting services to aid you with an efficient and seamless tax process. Corporation tax is levied on the profits of an incorporated business, and understanding how business expenses and corporation tax relief work can help reduce your tax liabilities.

As the business moves forward the amount spent by the business and the amount owned by the business are added to that balance to create a closing balance at the end of the first designated accounting period. Usually the person starting a business will have funds that they can pay into that business on day one, in which case these funds will represent the opening balance. An opening balance refers to the amount of money a business has at the beginning of a specific accounting period. Calculating an opening balance can also be useful when a business is analysing its performance, or to answer questions from external sources such as investors or the tax authorities.

Understanding Business Expenses and Corporation Tax Relief

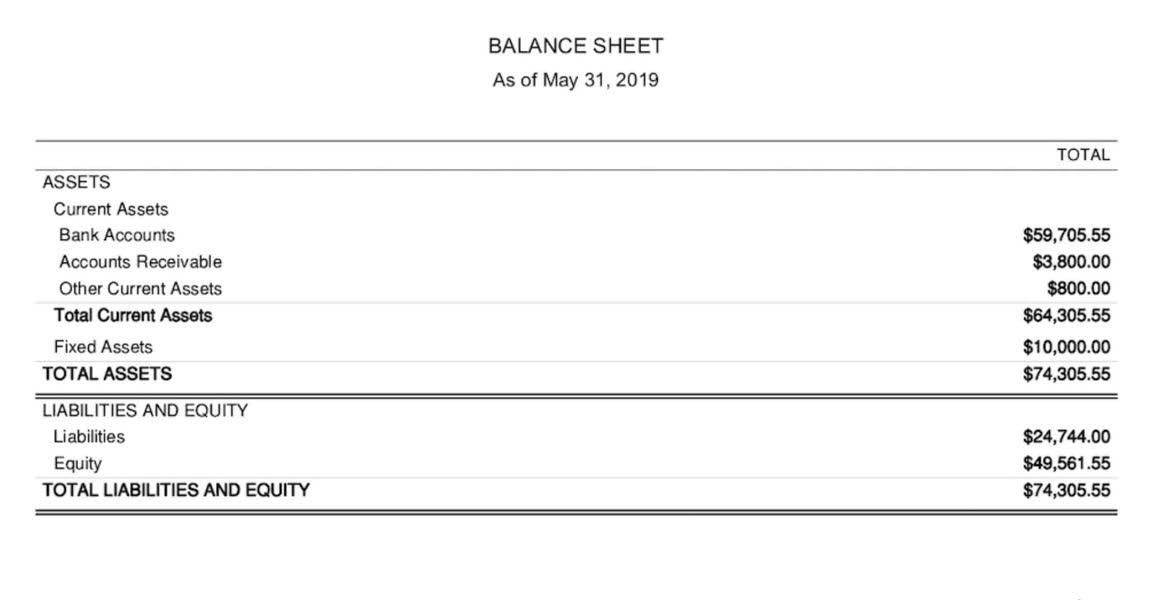

It serves as a starting point for assessing the company’s financial position and performance during the accounting period. The journal records the assets, liabilities and equity of the business in the general ledger as opening balances. Subsequent transactions for the accounting period can now be entered in the usual manner. With Mollie as your payment service provider, you get real-time access to your company’s invoices and payouts, along with a detailed overview of your current balance. Plus, you can export all that data to your accounting software in just a couple of clicks. So, when it comes to things like calculating opening balances, you’ve got everything you need at your fingertips.

- In many cases, the business owner will invest funds into the company in order to set it up, either from their own savings, in the form of investments from “angel” investors or a loan from the bank.

- Using accounting software can help you figure out what is missing, or you can fill out an accounting template and see the numbers in front of you.

- Accurate opening balances are essential for compliance with tax authorities and providing information to investors.

- Over the course of her first year in business, she received £27,000 from her customers, but had to pay out £14,000 to cover her expenses.

- When you start a new business your opening balances are zero, unless you spent money before setting it up.

What is a closing balance?

- The opening journal entry is made by extracting the closing balances of the previous financial year and reporting it as the opening balance of the current year.

- It is a key indicator of the company’s financial health and an indicator of where and how the company can grow.

- By introducing accounting software into your business model, these decisions can be made so much easier.

- But for an opening balance figure to be accurate, every transaction (whether that’s earnings or outgoings) has to be accurately recorded, either in your accounting software or your cash book.

- Accounting software, which is essentially one accounting system, can be a game-changer when it comes to managing opening balances.

- For example, the balance in your bank account at the end of your last accounting period, say December the 31st, was €2,000.

Generally, a new business assumes its opening balance to be zero since there’s no preceding accounting period to transfer any balance. However, if expenditures were incurred during the establishment process, these expenses would be carried forward and considered in the opening balance of the new financial year accounts. For example, the balance in your bank account at the end of your last accounting period, say December the 31st, was €2,000.